Just like any other industry, the Covid-19 pandemic has shaken the air cargo industry too. While the industry was struggling with capacity issues already, the new variant Omicron has started showing up in some parts of the globe making the air cargo fraternity fret about the future. Air cargo plays a crucial role in transporting high-value and time-sensitive goods domestically as well as internationally. Hence, its importance in the global supply chain is paramount. In the midst of the pandemic, shipments that took too long to be transported from one point to another were quickly shipped by air. International shipping from India also witnessed a surge in the number of air shipments. A detailed report by Seabury Consulting is able to shed light on the current air freight demand and capacity on a global basis.

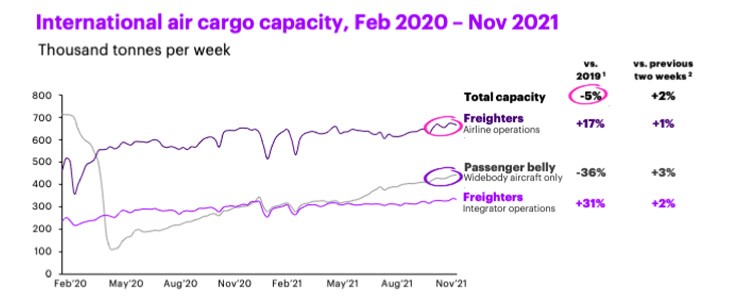

International air cargo capacity on the global scale increased +2% in the last two weeks. This total capacity increase has been achieved through both belly and freighter increases. If we compare against the strong Q4 in 2019, the growth of airline freighter cargo capacity has slowed down to +17%.

Source: Seabury Cargo Capacity Tracking Database, Seabury Cargo, Accenture Analysis (December 2021)

The weeks of 15-28 November 2021 compared to the same weeks in 2019.

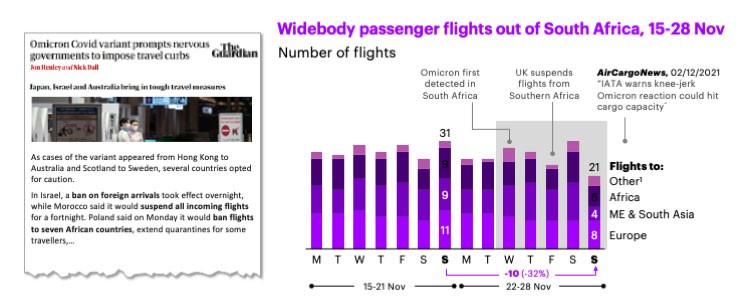

The belly cargo capacity had started recovering at a considerable pace but with the emergence of COVID’s omicron variant, the impact on the recent recovery of belly cargo is a matter of concern. With the suspension of passenger flights and several other curbs in various parts of the world due to the omicron scare, the cargo capacity could be hit in a drastic way. In fact, the same has already been warned by IATA.

Other signifies the Asia Pacific and North America.

Sources: “Omicron Covid variant prompts nervous governments to impose travel curbs”, The Guardian (29/11/2021), “IATA warns knee-jerk Omicron reaction could hit cargo capacity”, Air Cargo News (02/12/2021), Seabury Cargo Capacity Tracking database, Seabury Cargo, Accenture analysis (December 2021)

Although air cargo capacity had been recovering to 2019 levels during the end of November yet strong demand and congestion have put pressure on the prices compelling the prices on the transpacific to go up. WorldACD figures have revealed that global rates including charges until the week of December 5 2021 reached $4.57 per kg compared to $4.26 per kg. The increase in rates was led by the transpacific trade. Referring to the Baltic Exchange Airfreight Index (BAI), the prices from Hong Kong to America reached a record $14.30 per kg in the last week as compared to $12.41 per kg one week earlier. As per BAI, there was a slight dip in prices from Hong Kong to Europe. The price dropped from $8.46 per kg two weeks ago to $8.18 per kg in the last week. Nevertheless, it is still high as compared to historical levels. Furthermore, the rate from Frankfurt to North America was $5.10 per kg last week compared to $5.38 per kg two weeks ago.

Air freight forwarders in India have been experiencing a mad rush where shippers are switching from ocean freight to air freight. This demand has been impacting pricing big time and has ended up surging the landed cost of goods.

Navigating the intricacies of import customs clearance in Mumbai is essential for businesses engag.....

The bustling metropolis of Mumbai, where the air is thick with the aroma of chai and the streets are alive with the hum of commerce. In the heart of this vibrant city lies a crucial hub for interna.....

In today's rapidly evolving marketplace, the logistics sector plays a pivotal role in meeting the dynamic expectations of consumers for transparency, timely delivery, and innovation. As India&#.....